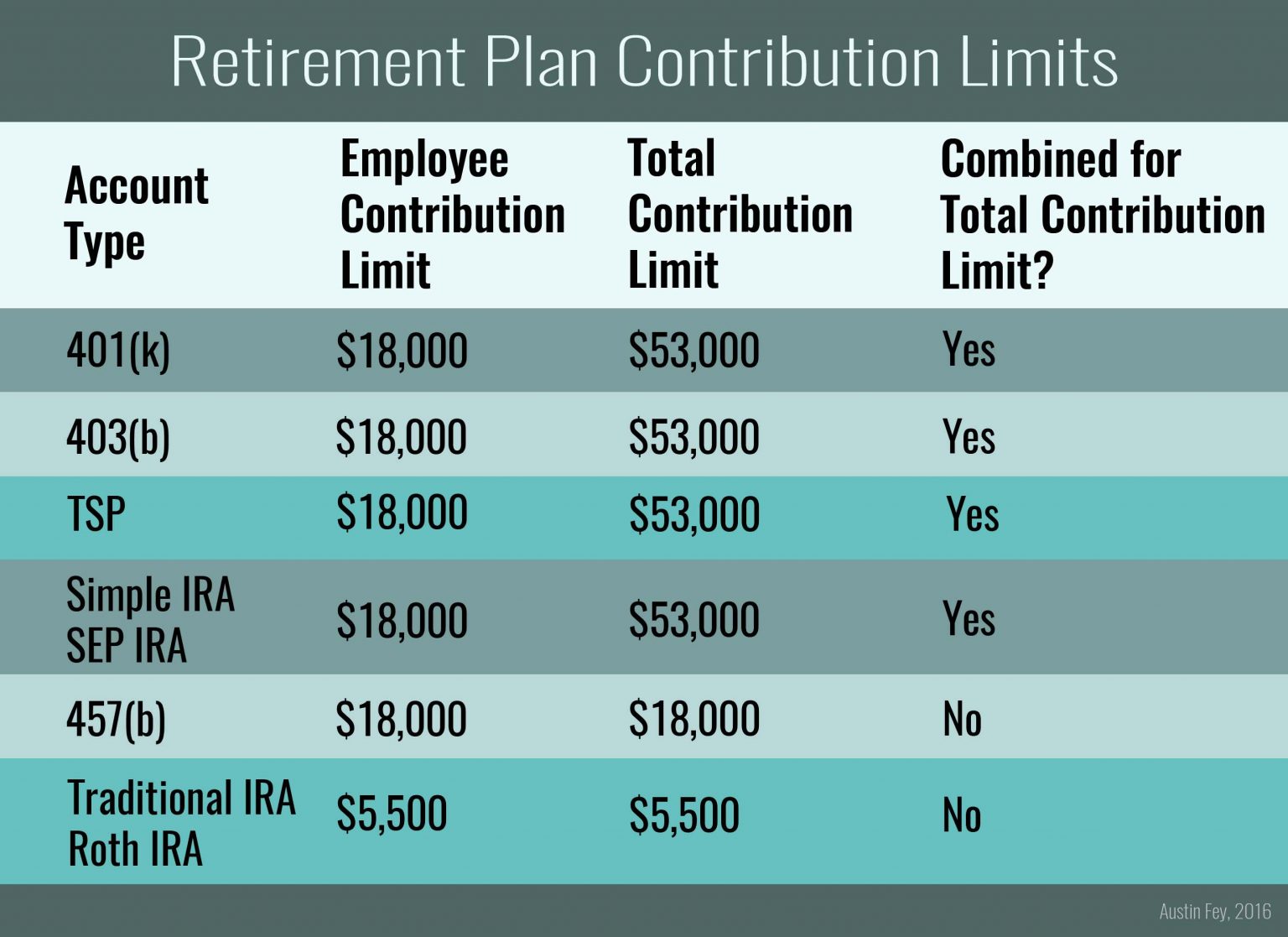

Simple Ira Contribution Limits 2025 Employer. The increased simple contribution limits apply automatically. Simple ira contribution limits for 2025 are up to $16,000 for the year.

Simple ira * 2025 contribution limit: Contribution limits increase for tax year 2025 for hsas, sep iras, simple iras, and solo 401(k)s.

Simple Ira Max For 2025 Tatum Carlotta, The maximum contribution was raised from $16,000 to $16,500.

Simple Ira Contribution Limits 2025 Over 50 Natalie Baker, An employee can — but is not required to — make salary reduction contributions to a simple ira.

simple ira employer contribution Choosing Your Gold IRA, Under the new secure act 2.0 provisions, the.

Simple Ira Maximum Contributions 2025 Jack Lewis, In 2025 the contribution limit goes up to $16,500.

2025 401(k) and IRA Contribution Limits Modern Wealth Management, Much like we mentioned before, those.

Theme by ThemeinProgress | Proudly powered by WordPress