How Much Can Be Gifted In 2025 Without Tax Consequences. This means you can give up to $18,000 per person each year without incurring any gift tax or affecting your. The internal revenue service (irs) has released its tax inflation adjustment figures for tax year 2025.

The irs annual gift tax limit is $18,000 for 2025 and $19,000 for 2025. Individuals can give up to $19,000 to any number of people in 2025 without triggering gift tax reporting requirements.

Tax Free Gifting 2025 Kitti Nertie, Married couples can effectively double this amount to $38,000 per.

2025 Tax Rates And Brackets Ontario Kimberly Underwood, The unified estate and gift tax exclusion amount, $13,610,000 for gifts made and decedents dying.

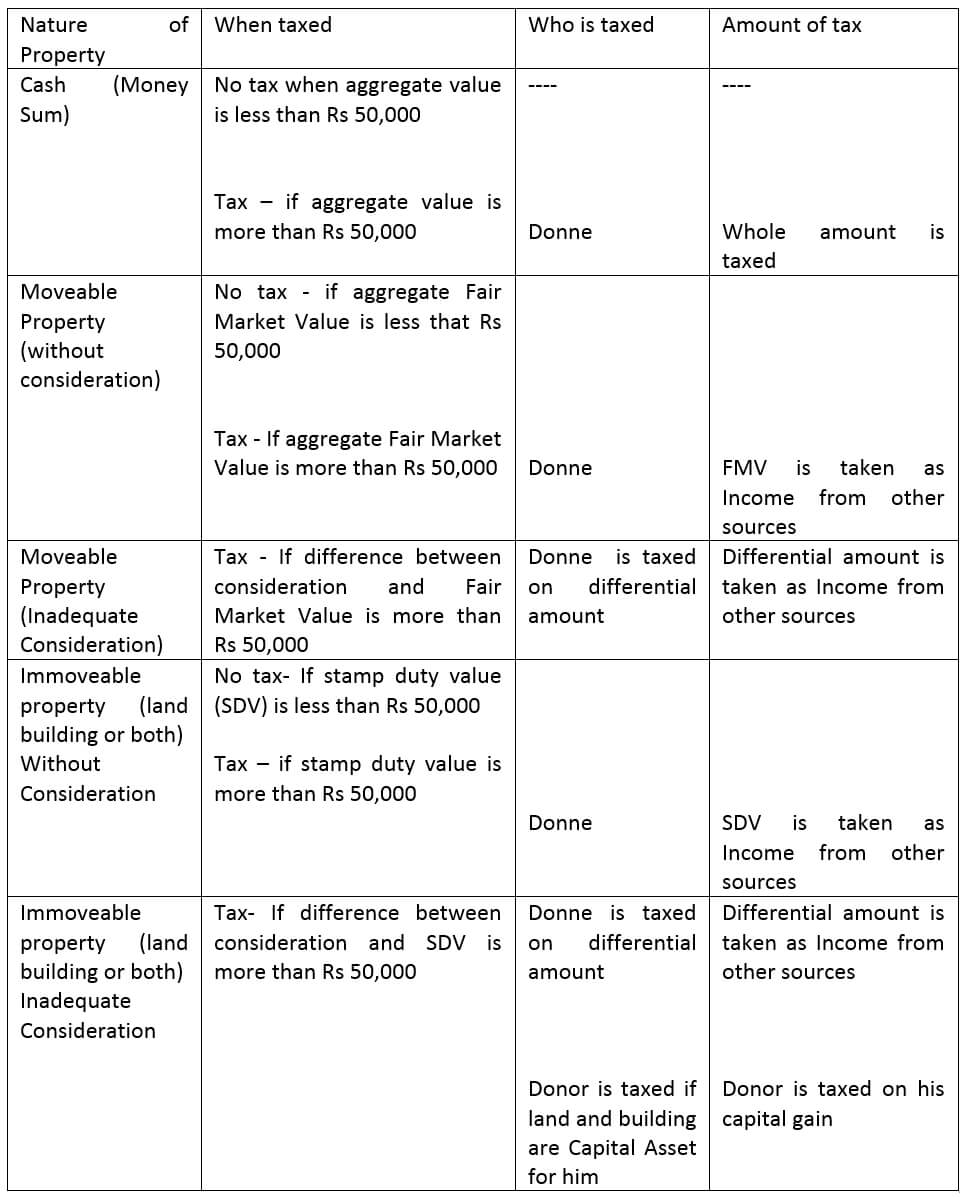

Tax implications on a gifted property Property lawyers in India, Married people typically can gift as much money to their spouses as they like without tax consequences.

Florida No Sales Tax 2025 Olympics Martin Riggs, The irs has specific rules about the taxation of gifts.

An insightful look at the consequences of professional tax violations, A couple who has already utilized their full lifetime gift exemptions will benefit from the 2025 increase.

Printable Calendar 2025 Without Downloading A Comprehensive Guide, The internal revenue service (irs) has released its tax inflation adjustment figures for tax year 2025.

Capital Gains on a Gifted Property Impact, Tax Considerations, Normally, you don't pay tax on gifts from parents.

Gifted Challenges™ Gifted adults Key questions that can help improve, Effective january 1, 2025, you will be.