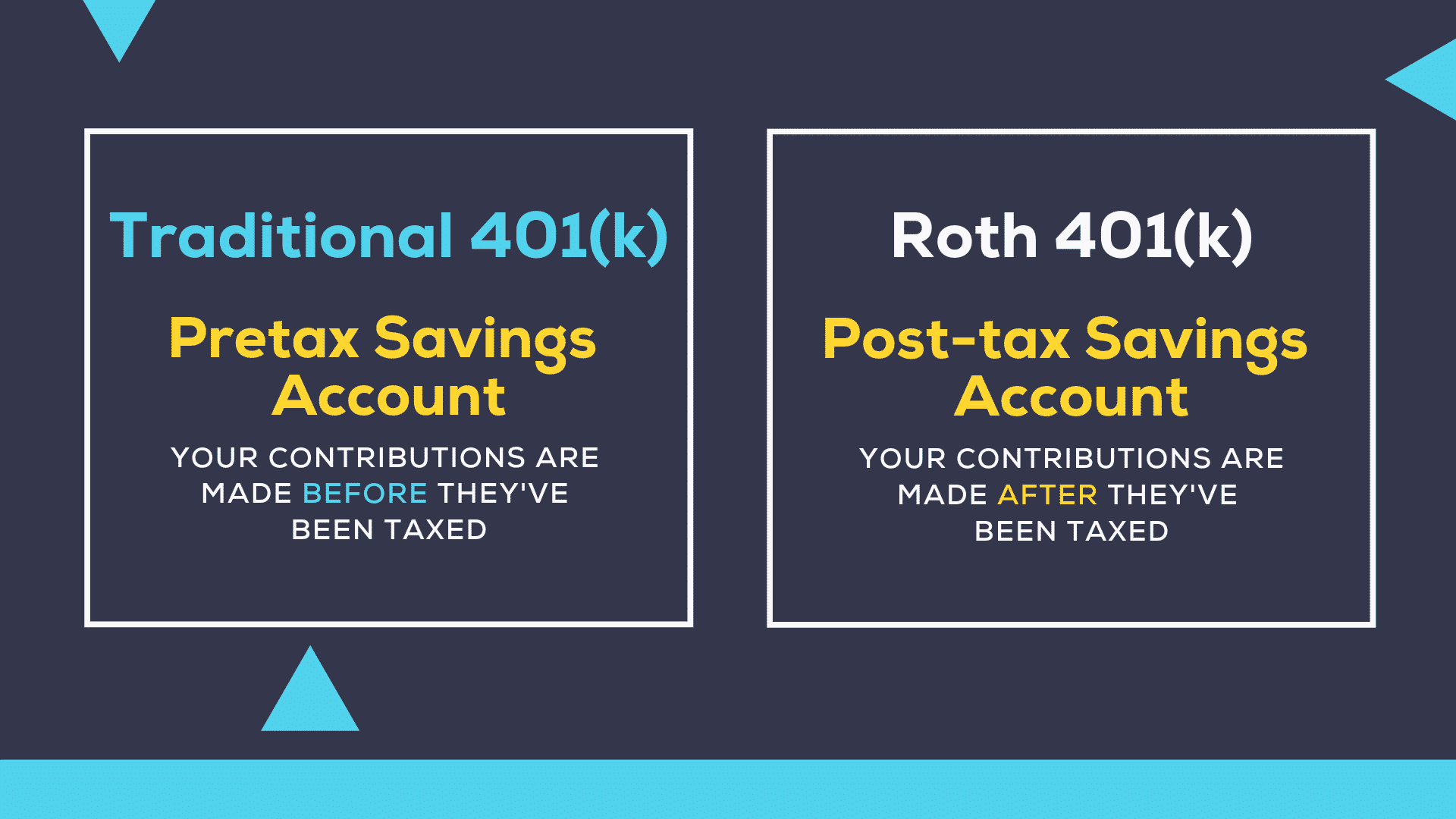

The 401 (k) contribution limit is $23,000 in 2025. Beginning this year (2025), the secure 2.0 act eliminates rmds for qualified employer roth plan accounts.

Free 401k calculator to plan and estimate a 401k balance and payout amount in retirement or help with early withdrawals or maximizing employer match. What are the 401(k) contribution limits for 2025?

The maximum amount you can contribute to a roth 401 (k) for 2025 is $23,000 if you’re younger than age 50.

2025 Roth 401k Limits Moira Lilllie, The overall 401 (k) limits. This is an extra $500 over 2025.

2025 Roth Maximum Contribution Gina Phelia, This limit includes all elective employee salary deferrals and any contributions. You can invest up to $23,000 in 401(k) plans in 2025, and anyone age 50 or older can put in an extra $7,500.

SelfDirected Roth Solo 401k Contribution Limits for 2025 My Solo, Roth 401 (k) employee contributions are. For 2025, the contribution limits for 401 (k) plans have been increased.

2025 Retirement Plan Contribution Limits 401(k), IRA, Roth IRA, HSA, The irs has raised the annual contribution limit for roth 401(k)s to $23,000 for 2025. If you have a roth ira, the maximum in 2025 is $6,500.

Max 401k Contribution 2025 Including Employer Naukri Shay Benoite, It's not a huge jump,. The roth 401(k) contribution limit for 2025 is $23,000 for employee contributions and $69,000 total for both employee and employer contributions.

How Much Can I Contribute To My 401k In 2025 Emelia, This is an extra $500 over 2025. The 401(k) contribution limits for 2025 are $23,000 for people under 50, and $30,500 for those 50 and older.

What’s the Maximum 401k Contribution Limit in 2025? (2025), Beginning this year (2025), the secure 2.0 act eliminates rmds for qualified employer roth plan accounts. Free 401k calculator to plan and estimate a 401k balance and payout amount in retirement or help with early withdrawals or maximizing employer match.

Last Day For Roth Ira Contribution 2025 Amara Bethena, You can invest up to $23,000 in 401(k) plans in 2025, and anyone age 50 or older can put in an extra $7,500. In 2025, the limit was $6,500.

Roth Ira Max Limits 2025 Wini Amandie, The irs also sets limits on how much you and your employer combined can contribute to your 401. Employees can invest more money into 401(k) plans in 2025, with contribution limits increasing from $22,500 in 2025 to $23,000 in 2025.

2025 Roth Contribution Limits Ellyn Hillary, If you're age 50 or older,. Here are the 2025 401k contribution limits.